CRAFT Framework: $90k to $7.8M in Under 6 Years

Buying your first business is scary.

You’re anxious to get in the game but can’t afford to miss.

You’ve heard “buy a great business at a fair price” but how do you know what “fair” is?

Here’s how I turned $90k to $7.8M in under 6 years.

Minimize Downside Risk

Right now, you only have on goal: Minimize your downside risk.

But you can’t minimize your downside risk if you don’t know the value of what you’re looking at.

The CRAFT Framework makes this easy:

C – Cashflow

R – Risk minimization

A – Analysis

F – Financing

T – The Model

Continue reading for more information.

Cashflow

Identifying cashflow is the most important step in the process.

You will use this number for your valuation so it HAS to be right.

The equation is simple but calculating it is not: CF = Cash In – Cash Out

Don’t be prideful. Use a CPA, financial whiz or investor to help.

Risk Minimization

You aren’t some deep-pocketed investor. This is your first business!

Underwrite the business based on its current state. Not what it did 3 years ago or what you think you can do.

What it’s doing right now:

- Be skeptical

- Be paranoid

- Be sober

Analysis

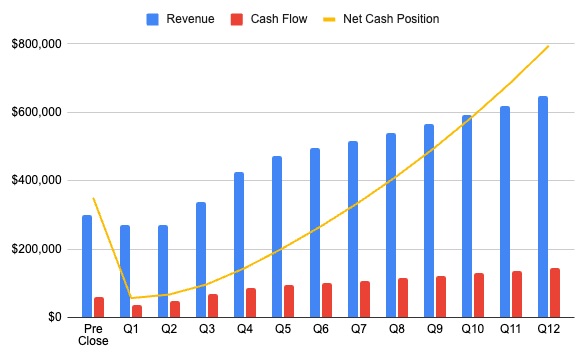

You need to know, post closing, how the business will perform.

Start by asking these questions:

- How would the business do if I took over today?

- With the current owner gone, what do I need to cut or add?

- How will the J-Curve look post close? (👇)

Financing

You cannot come to a valuation if you do not understand how financing works.

Gather this information:

- Loan rate

- Loan Term

- Loan Amortization period

- Your Debt Service Coverage Ratio (DSCR) range

- Cash down requirement (bank)

- Your preferred Cash down

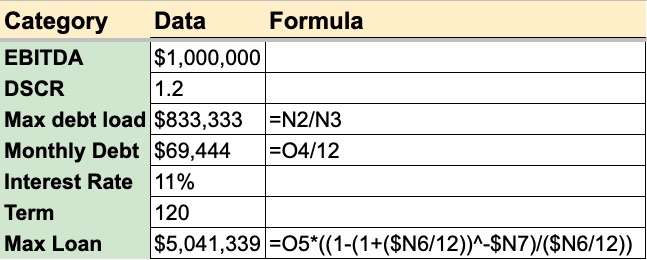

Understanding DSCR

What is DSCR & why is it important?

Banks decide how much you can borrow based on how much debt the business can handle.

But you should be MUCH more conservative.

Why? You want a cushion

Check out this example below.

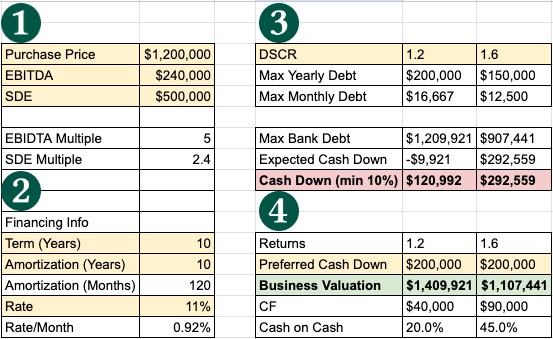

The Model

With all that work done, let’s plug it in!

Step 1. Enter Purchase Price, Cash Flow Proxy,

Step 2. Enter loan Term, Amortization Period and Rate

Step 3. Enter the your DSCR range

Step 4. Evaluate your Returns and iterate

Here is a screenshot of my tool below.

Conclusion

Buying your first business doesn’t have to be overwhelming. The CRAFT Framework gives you a clear, step-by-step process to evaluate any opportunity and protect your investment.

The tool and framework that helped me grow $90k into $7.8M can work for you too, but only if you put in the work to properly evaluate each opportunity.

Key Takeaways:

- Always start with accurate cashflow calculations—get professional help if needed

- Underwrite based on current performance, not past success or future hopes

- Be skeptical, paranoid, and conservative in your analysis

- Understand your financing options and DSCR requirements before making offers

- Use the CRAFT model to systematically evaluate every deal

- Focus on minimizing downside risk rather than chasing maximum returns

- Don’t rush—take time to properly analyze each opportunity

Start small, stay disciplined, and let the framework guide your decisions. Your first business acquisition is just the beginning.

For a copy of the tool, follow me on X, and send me a DM! You can also follow me on Instagram and Patron View for more.